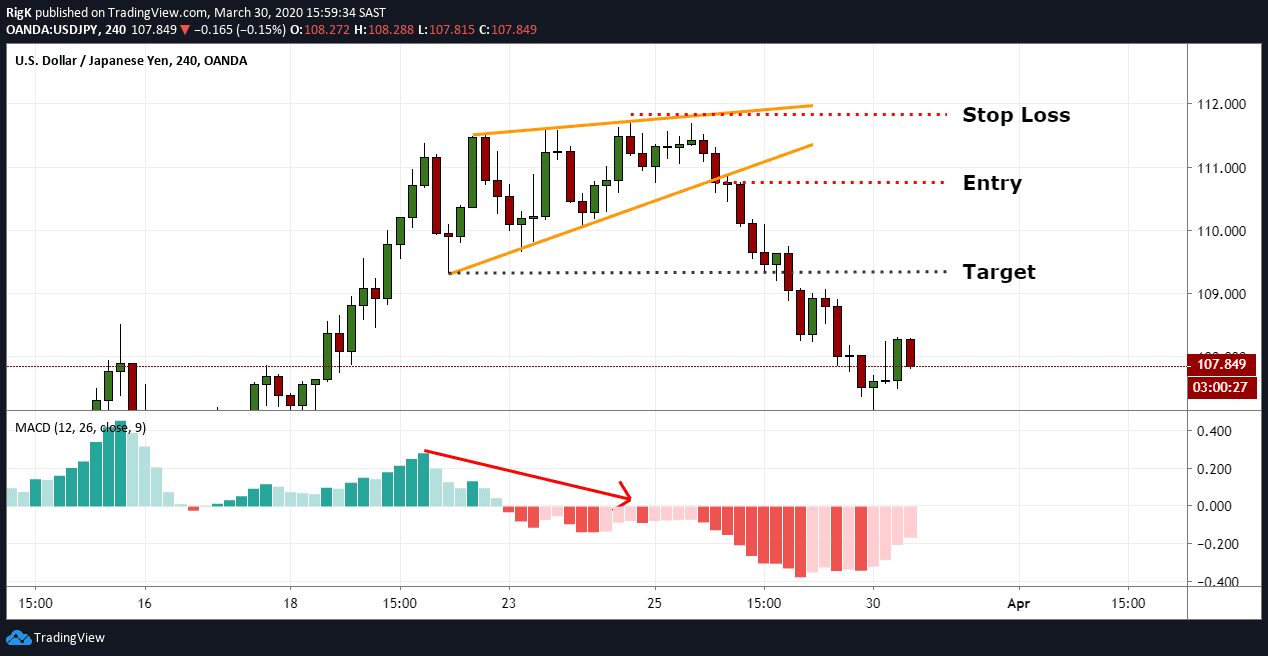

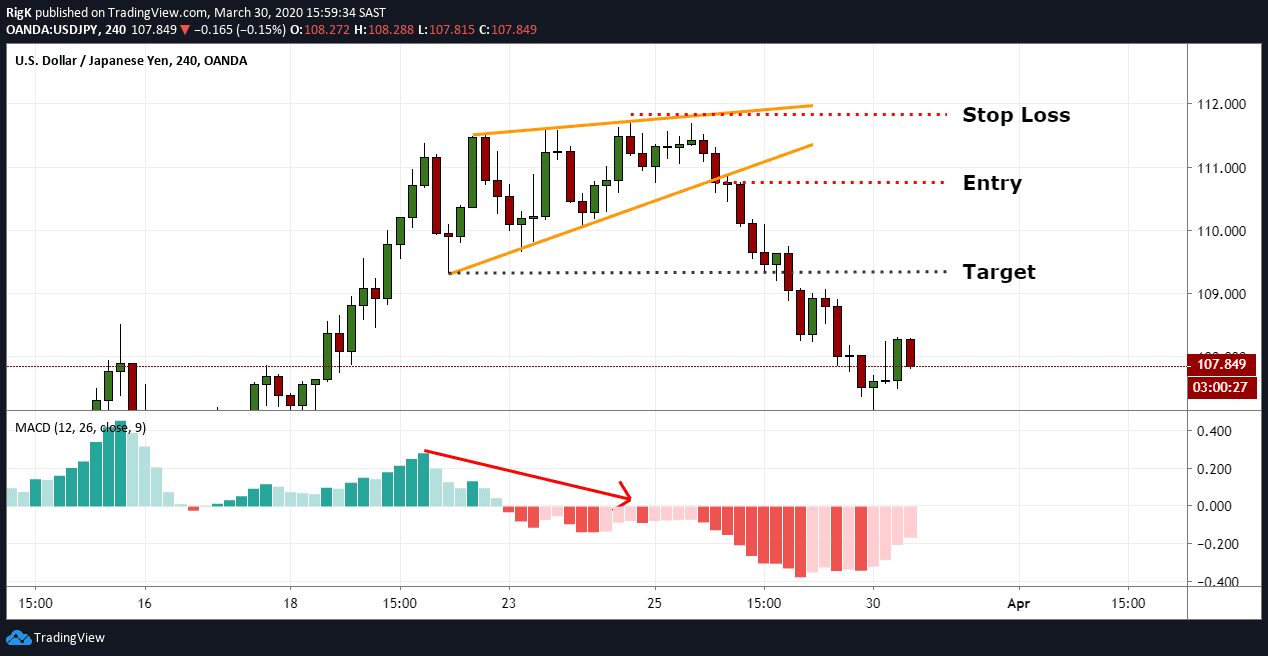

Manage risk appropriately for your account size.Book partial profits at Fibonacci levels.Set stop loss beyond opposite side of pattern.

Enter on breakout confirmation near the breakdown point. Wait for a confirmed breakout – don’t anticipate. Identify previous trend – wedges are continuation patterns. When trading rising wedges, it’s essential to maintain disciplined strategies: Use Fib levels to target potential take profit zones. Take partial profits at the -127% or -161% Fibonacci extension levelsīearish breakdowns don’t occur as frequently, but can result in sharp declines when they do happen. Place a stop loss above the wedge resistance line. Enter a short position as close to the breakout as possible. Wait for a confirmed close below rising wedge support.

Enter on breakout confirmation near the breakdown point. Wait for a confirmed breakout – don’t anticipate. Identify previous trend – wedges are continuation patterns. When trading rising wedges, it’s essential to maintain disciplined strategies: Use Fib levels to target potential take profit zones. Take partial profits at the -127% or -161% Fibonacci extension levelsīearish breakdowns don’t occur as frequently, but can result in sharp declines when they do happen. Place a stop loss above the wedge resistance line. Enter a short position as close to the breakout as possible. Wait for a confirmed close below rising wedge support.  Look for a preceding downtrend before the wedge formed. Use Fib levels to target potential take profit areas. Take partial profits at the 127% or 161% Fibonacci extension levelsīullish breakouts from rising wedges can result in powerful impulsive moves, signaling a continuation of the previous uptrend. Place a stop loss below the rising wedge support line. Enter a long position as close to the breakout as possible. Wait for a confirmed break above resistance with increased volume. Identify an uptrend preceding the wedge. Here are some tips for trading a rising wedge with a bullish breakout: In either case, the key is waiting patiently for a confirmed breakout before entering a trade. This occurs approximately 25-40% of the time. Sometimes, rising wedges will see bearish breakouts, especially if the previous trend was down. This occurs approximately 60-75% of the time in rising wedges. If the previous trend is up, the breakout will likely be bullish, signaling a resumption of the uptrend. The rising wedge is considered a continuation pattern, meaning breakouts typically happen in the overall direction of the previous trend. This squeezes price action tighter within the wedge until an eventual breakout occurs. Here is an example of a rising wedge pattern that formed on the EUR/USD daily chart:Īs you can see, the upward sloping resistance line has a steeper downwards slope than the support line. This builds the tension leading up to an explosive breakout. The most important factor is the sloped resistance line being steeper than the support line. Higher highs and higher lows as wedge takes shape. Price contracting within the pattern as it progresses. Resistance line sloping downwards more steeply than support. At least 2 reaction lows touching the lower support line. At least 2 reaction highs touching the upper resistance line. There are a few key things to look for when identifying a rising wedge pattern: Trading range compresses as wedge takes shape. Price makes higher highs and higher lows.

Look for a preceding downtrend before the wedge formed. Use Fib levels to target potential take profit areas. Take partial profits at the 127% or 161% Fibonacci extension levelsīullish breakouts from rising wedges can result in powerful impulsive moves, signaling a continuation of the previous uptrend. Place a stop loss below the rising wedge support line. Enter a long position as close to the breakout as possible. Wait for a confirmed break above resistance with increased volume. Identify an uptrend preceding the wedge. Here are some tips for trading a rising wedge with a bullish breakout: In either case, the key is waiting patiently for a confirmed breakout before entering a trade. This occurs approximately 25-40% of the time. Sometimes, rising wedges will see bearish breakouts, especially if the previous trend was down. This occurs approximately 60-75% of the time in rising wedges. If the previous trend is up, the breakout will likely be bullish, signaling a resumption of the uptrend. The rising wedge is considered a continuation pattern, meaning breakouts typically happen in the overall direction of the previous trend. This squeezes price action tighter within the wedge until an eventual breakout occurs. Here is an example of a rising wedge pattern that formed on the EUR/USD daily chart:Īs you can see, the upward sloping resistance line has a steeper downwards slope than the support line. This builds the tension leading up to an explosive breakout. The most important factor is the sloped resistance line being steeper than the support line. Higher highs and higher lows as wedge takes shape. Price contracting within the pattern as it progresses. Resistance line sloping downwards more steeply than support. At least 2 reaction lows touching the lower support line. At least 2 reaction highs touching the upper resistance line. There are a few key things to look for when identifying a rising wedge pattern: Trading range compresses as wedge takes shape. Price makes higher highs and higher lows.

Resistance line has steeper slope than support.Price bounded within upward sloping support and resistance lines.Eventually, price breaks out explosively in either direction when it reaches the apex of the wedge. This builds tension as the asset’s trading range narrows. The upper resistance line has a steeper slope than the lower support line. As the wedge takes shape, the asset makes higher highs and higher lows. What is the Rising Wedge Pattern?Ī rising wedge is a bullish chart pattern that forms when price becomes compressed inside upward sloping support and resistance lines that converge together.

#Rising wedge trading how to#

In this comprehensive guide, we’ll cover everything you need to know about the rising wedge pattern and how to effectively trade it. This powerful formation can help traders identify potential breakouts and reversals. The rising wedge is one of the most commonly seen chart patterns in technical analysis. Robo Wealth Investment Service by BESTMT4EA.

0 kommentar(er)

0 kommentar(er)